Summary

Over the past 20+ years and at different times in the economic cycle, MV Credit has often been asked if subordinated debt has a future. Whilst the market has evolved, with the toolkit expanding from mezzanine, to include second lien, PIK, and preferred equity instruments for instance, it has continued, ensuring that subordinated debt instruments prevail as relevant investments and financing solutions.

MV Credit estimates the European subordinated (also known as mezzanine or junior) debt market at around 10% – 15% of the total corporate private debt market, therefore representing a specialist segment within the asset class1. It consists of a limited number of non-bank institutions with different focusses on geographies, transaction sizes and risk/return requirements (e.g. equity-like strategies vs. credit-driven approaches). As a subordinated debt expert, MV Credit believes that the solutions lenders can offer makes it attractive to both investors, by pricing a premium, and (private equity) sponsors in search of tailored financing.

Where does subordinated private debt sit in the debt market?

A specialist market

While the senior debt space is shared among banks and private lenders, subordinated debt is primarily provided by lenders such as MV Credit. Most banks are reluctant to provide this type of subordinated solution primarily due to the illiquid nature of the debt and its high capital requirements on their balance sheet.

Private debt lenders can bridge this financing gap by providing tailor-made solutions to sponsors and borrower companies, certainty on economics, legal terms and certainty of deliverability during the structuring processes. Subordinated debt financings are negotiated bilaterally between sponsors and a limited number of private debt providers. As sponsors tend to have existing precedents with selected subordinated debt providers, each financing process may involve only a modest number of potential providers. The majority of the private debt fund lenders are focused on senior direct lending, rather than managing dedicated subordinated strategies like MV Credit. MV Credit is typically the sole or lead arranger in subordinated transactions2.

In addition, subordinated lenders offer the typical private debt advantages to borrowers such as:

- Providing flexible debt structures (e.g., cash vs. PIK interest) with known precedent documents;

- Providing financing in size;

- Providing multiple currencies (e.g., EUR, GBP, USD);

- Speed of execution, length of credit processes and direct access to decision makers;

- Existing relationship with corresponding sponsor through repeat transactions.

A complementary offering to senior debt

First and foremost, relationships with sponsors play a key part to enable privileged and early access to subordinated origination. However, the nature of the senior lenders in the capital structure can vary, subordinated debt can be placed alongside both private senior debt and senior syndicated debt, especially in the mid to large cap transactions. In recent markets, the more expensive pieces of private senior debt, typically unitranche, have opportunistically been refinanced in the syndicated market at a tighter pricing and leverage. While there is depth in this market, the appetite for leverage can restrict the amount raised in private markets, potentially leaving space for a turn of junior debt and creating an opportunity for subordinated lenders to bridge the gap. Other times, subordinated debt sits directly behind a senior or unitranche debt provided by a club of lenders.

The competition between traditional subordinated debt lenders in Europe has remained stable overall. MV Credit attributes this to a number of historical players exiting the market to focus on senior direct lending and lower mid cap strategies or private equity strategies after the financial crisis and the segmentation of the landscape by size (large, mid or small cap) or geographies (national, Pan-European or US-focussed players). In this specialist market, having a long track record and lasting relationship with sponsors, through the good times and when managing tougher situations is more relevant than ever.

Why do sponsors add subordinated debt to the capital structure?

Permit growth investments while alleviating pressure on company’s cash flow

Sponsors may acquire companies with the aim of executing a transformation plan, which in many cases include consolidating a fragmented market through an accelerated acquisition strategy. This can be funded with the cash flows generated by the borrower and/or debt raised to finance such acquisitions. Unlike most senior debt, subordinated debt can provide flexibility to capitalise interest (non-cash PIK) allowing sponsors to execute buy-and-build strategies by alleviating cash flow pressures.

Similarly, subordinated debt can fund expansion capex plans (i.e. building or acquiring a new site) or extracting synergies from mergers of two companies, without additional pressure on cashflows from incremental senior debt.

Ultimately subordinated debt is an effective tool for financing growth and remains less costly to sponsors than equity.

Access cash generative high valuation businesses

Subordinated debt allows sponsors to invest in businesses with high valuations in attractive end-industries such as healthcare, software, business services or education (EV >12x EBITDA). Even in the current interest rate environment, the cost of subordinated debt provides an arbitrage against equity financing, considering the expected 15-20% returns of sponsors. Subordinated debt allows sponsors to differentiate and bid for attractive companies that otherwise their funds would not be able to buy given their fund size and target returns constraints.

We also note that as a lender, equity valuation does not drive how the credit risk of an investment is assessed. MV Credit focuses on fundamental credit metrics such as equity cushion. For subordinated transactions we looked at over the past five years, equity cushion remained above 50% with average debt multiples of c.7.0x3.

Assist with capacity constraint

Sponsors’ funds typically operate in 5-year investment cycles, after which their ability to provide additional capital can be legally or commercially constrained. In such scenarios, subordinated debt can provide a short-term bridge financing to allow them to execute the final part of their portfolio company’s business plan (i.e. final acquisitions) ahead of a sale of the business.

Why is subordinated debt attractive for investors?

Attractive risk-adjusted returns

MV Credit believes that the illiquidity premium achieved by investing in private markets, in comparison to public securities, provides an attractive return per unit at risk taken. MV Credit does not believe this opportunity is easy to find in the public universe, where investment inefficiencies are infrequent. This premium is enhanced the more junior the instrument in the capital structure, where bespoke structures are bilaterally negotiated.

The gross yield of European subordinated debt instruments is currently between 13% to 16%, inclusive of the features listed below:

- Interest payments consist of a cash and/or payment-in-kind (“PIK”) margin above the EURIBOR/SONIA/LIBOR base rate. The total margin is considerably higher than that of senior debt and high yield bonds, with current interest of EURIBOR/SONIA/LIBOR + [8.25-12.0]% (including the cash component) .

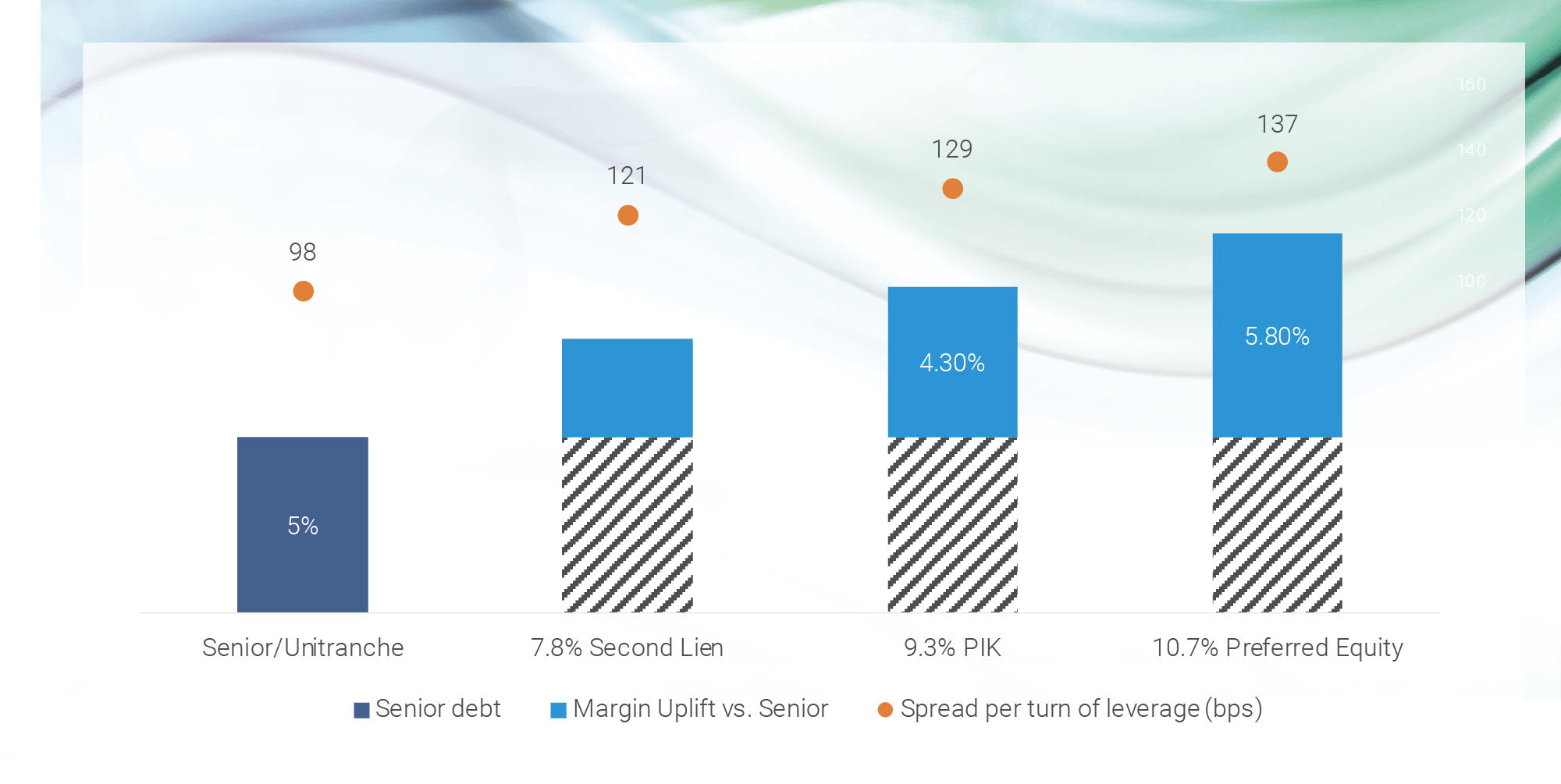

- MV Credit investments over the last 10 years demonstrate attractive margin levels (Figure 1), the more junior instruments benefit from an uplift in margin to remunerate the higher leverage exposure, this is measured by the spread per turn of leverage. PIK and preferred equity instruments can be 2nd ranking or rank more junior in the capital structure.

Figure 1: MV Credit’s average total margin per instrument over the last 10 years4

- Instruments benefit from additional economic upside such as arrangement/upfront fees, we see them ranging between 2 % and 3% of the facility.

- Subordinated debt usually includes non-call and/or prepayment penalty periods for the first 2 to 3 years, combined with upfront fees, it deters borrowers from refinancing the facility early and protect returns when markets reprice down.

- Unlike high yield and other fixed rate instruments, the floating rate nature of European private debt instrument provides investors with protection in a changing interest rate environment.

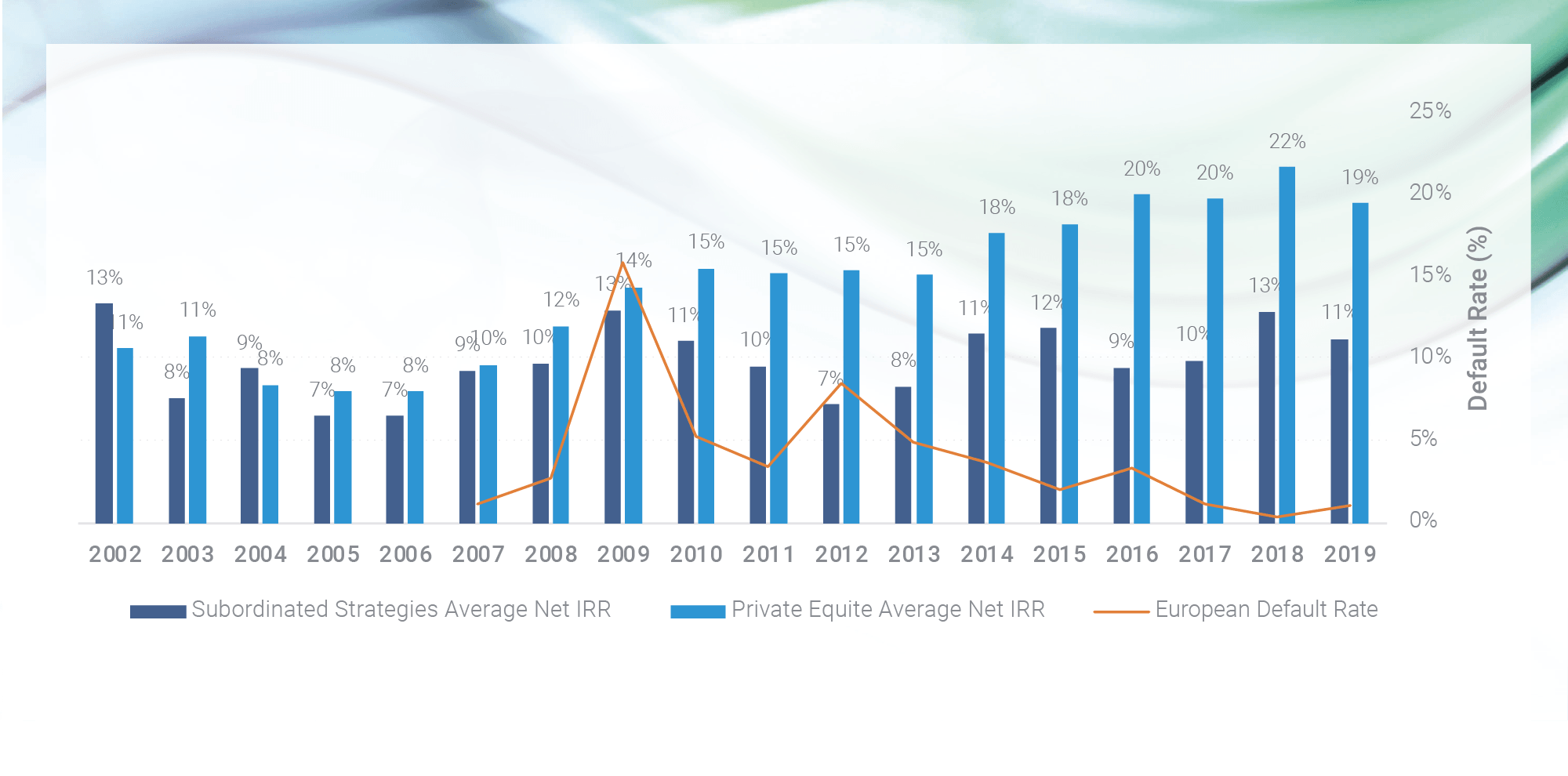

Delivering consistent returns within private markets

Subordinated debt offers a similar sharpe ratio to senior strategies and a higher ratio compared to private equity strategies (Figure 2), indicating better risk-adjusted performance. The strategy has demonstrated higher historical returns compared to senior debt and a competitive return profile with private equity style yields without risk of valuation multiples. The distribution profile of private debt funds is more predictable and does not rely on an active M&A market to deliver. With similar levels of volatility and higher absolute returns than senior strategies, subordinated strategies are opportune to diversify a pure senior direct lending allocation and improve the overall returns of the asset class bucket.

Figure 2: Risk-return of subordinated, senior and private equity strategies

(2002-2019 vintages)5

| Subordinated Strategies | Senior Strategies | Private Equity Strategies | |

|---|---|---|---|

| Average Return | 9.9% | 7.3% | 14.4% |

| Volatility | 2.1% | 2.0% | 4.3% |

| Sharpe Ratio | 4.8 | 3.7 | 3.4 |

More strikingly, for 2002-2010 vintages that were invested during a high default rate environment (investment periods for subordinated and private equity funds are both typically 5 years), average returns were 10% for subordinated strategies vs. 11% for private equity6, showing that subordinated investors benefit from downside protection.

Figure 3: Average return per vintage year7

Control Features and Information Rights

When investing in subordinated debt, the lender typically benefits from control features, often with a blocking minority stake. In addition, typically 100% of subordinated lenders will need to consent to certain actions such as extending the terms of debt, changes to pricing and waivers of default which provides investors like MV Credit with more control.

Experienced lenders in subordinated debt are in a better position to request additional information rights such as monthly, not quarterly, performance information to strengthen the monitoring of portfolio companies.

Conclusion

Subordinated debt is a small but rich part of the corporate debt market. Successfully originating subordinated debt requires deep relationships with sponsors to enable privileged and early access to subordinated origination opportunities as they arise. Subordinated origination can be scarcer or lumpier than senior origination over a short period of time, however, the range of solutions enables managers to offer attractive terms to investors, deploy across macroeconomic cycles and answer sponsors’ specific needs.

Having raised and deployed five vintages of pure subordinated strategies, MV Credit is among a minority of managers who can demonstrate the track record necessary to offer expertise in this asset class.

Footnotes

1 Preqin, out of c.€100bn private debt market. Data sourced: November 2023.

2 Over 50% of invested amount, MV Credit proprietary data. Subordinated transaction in the period of September 2021 – September 2023.

3 Source: MV Credit, as at 31st December 2023

4 Source: MV Credit, as at 30th September 2023. 10 years from 2013 to 30th September 2023. Total margin: PIK margin + Cash margin. Weighted average of MV Credit’s invested amounts.

5 Source: Preqin, as of November 2023

6 Source: Preqin, as of November 2023

7 Source: LCD ELLI Default Rates, Preqin, as of November 2023